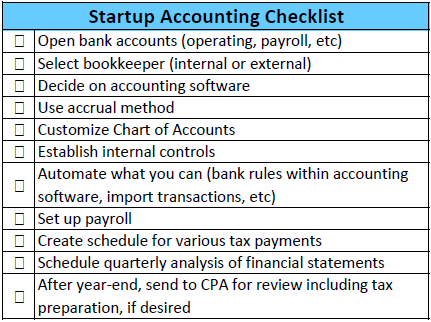

Startup Accounting Checklist

There are many activities that go into starting a business. Some are given little thought and low priority. Cape May Counting House understands that having the proper setup for your accounting activities will make your job as a new business owner immeasurably easier.

Below is our Startup Accounting Checklist which will make your life easier as you put systems and procedures into place to ensure your business can get the right information when needed.

Having a competent bookkeeper, either in-house or external, will give you the confidence that transactions are recorded properly.

Decide upon accounting software that makes sense to you and your business. What apps do you anticipate using and will they integrate with your potential accounting software?

There are two methods of accounting – the cash basis and the accrual basis. A lot of businesses chose the cash basis because of its ease. However, the accrual method provides much more clarity. It may be a bit more involved but it gives you a clearer picture of your operation.

Your Chart of Accounts lists all of the accounts that you will be using in the operation of your business – assets, liabilities, equity, revenue, and expense accounts. While you want detail in your financial statements do not indiscriminately add accounts causing your COA to become bloated and unwieldy.

Establishing internal controls such as a segregation of duties (splitting up tasks between different team members to minimize the occurrence of fraud) will go a long way in keeping your operation running smoothly, and with integrity.

Automate whatever you can. This gets back to your selection of accounting software. Data entry takes time and whatever you can automate including the importing of transactions will save you so much time. Furthermore, a workflow management app such as ClickUp can allow you to create workflows, set deadlines, assign team members, and more to keep you current and eliminate tasks from falling through the cracks.

Generating financial statements is easy. To measure the success of your business and identify and correct weaknesses you actually need to analyze them. Financial statements tell a story and you need to know what that story says about your business.

After you have finished out the year, send your statements to your CPA so that they can be reviewed and used to prepare your taxes.

We wish you much success on your new business venture!